Banks as corrupt as organised crime

Banks as corrupt as organised crime but without the jail time.

Thats the message that banks are giving and yet we still trust them with our money? or do we? Over the past several years banks have been settling case after case from currency and gold price fixing to money laundering to assisting tax evasion, these are some of the settlements high street banks are settling with lets face it your money.

Banks to pay £166bn over six years

From Libor rigging and sanction busting to forex manipulation, a look back at the global banking industry’s offences and penalties

Libor rigging

UK and USA authorities have fined banks more than $3bn into rigging of the benchmark Libor rate. Barclays at the heart of the Libor scandal, was fined £290m where Lloyds was fined £218m.

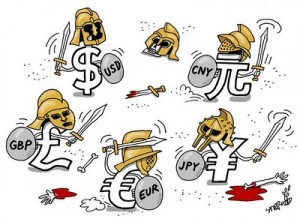

Currency rigging

Over 6 banks were fined 4.3 billion for rigging the currency markets

- Citigroup paying $1.02 billion

- JPMorgan paying $1 billion

- UBS paying $800 million

- Royal Bank of Scotland paying $634 million,

- HBSC paying $618 million.

- Bank of America paying $250 million.

Sanction busting

In 2012 Standard Chartered agreed to pay a fine of $340m. It was alleged to have been hiding billions of Iran money.

Money laundering

In 2012 the bank HSBC paid over $1.9billion to settle money laundering allegations for the cartel such as Mexican drug barons.

Electricity market manipulation

Barclays has been given a £330m penalty for rigging electricity markets. It is contesting the fine.

Gold price fixing

In May, Barclays was fined £26m for failing to stop the price of gold being manipulated.

Assisting tax evasion

Credit Suisse in May pleaded guilty to criminal charges that it helped Americans evade taxes, leading to a fine of $2.6bn.

Recent Posts

Why Banks Aren’t Always Best » « Drug lords using currency for laundering